A cash flow plan is an essential financial document for business management. It helps anticipate cash flows over a given period, typically monthly, to ensure that the business has the necessary liquidity to meet its short-term obligations. Indeed, a rigorous cash flow management is crucial to ensure that the business has the liquidity needed to operate on a daily basis. By creating a cash flow plan, the business can anticipate its expenses and income, plan its investments, and manage its repayments.

What is the purpose of a 13-week cash flow forecast?

A 13-week cash flow forecast allows businesses to closely monitor cash flows in the short term. It helps anticipate financing needs by identifying periods when the business might lack liquidity, allowing for adjustments in spending or seeking financing. It also optimizes cash flow management by helping businesses better manage collections and disbursements, adjusting payments based on liquidity availability. A cash flow forecast also helps avoid payment defaults by ensuring the business always has enough cash to pay its ongoing expenses, such as salaries, suppliers, and taxes. Additionally, it helps businesses make informed decisions and adjust short-term strategies based on the evolution of financial flows.

Why 13 weeks?

The choice of 13 weeks is based on several practical factors. A 13-week period is short enough to provide accuracy on cash flows without being influenced by long-term uncertainties. It also aligns with the financial cycles of many businesses, which often operate on quarterly or monthly schedules, and this period matches regular payment deadlines like salaries and bills. Moreover, it allows for proactive management, giving businesses a time window that enables them to take corrective actions if needed in the short term.

How is a cash flow forecast presented?

A cash flow forecast is typically presented as a table that predicts future cash flows, estimating both incoming (collections) and outgoing (disbursements) cash over a given period. This table helps the business anticipate cash flow fluctuations and make informed decisions for proactive financial management.

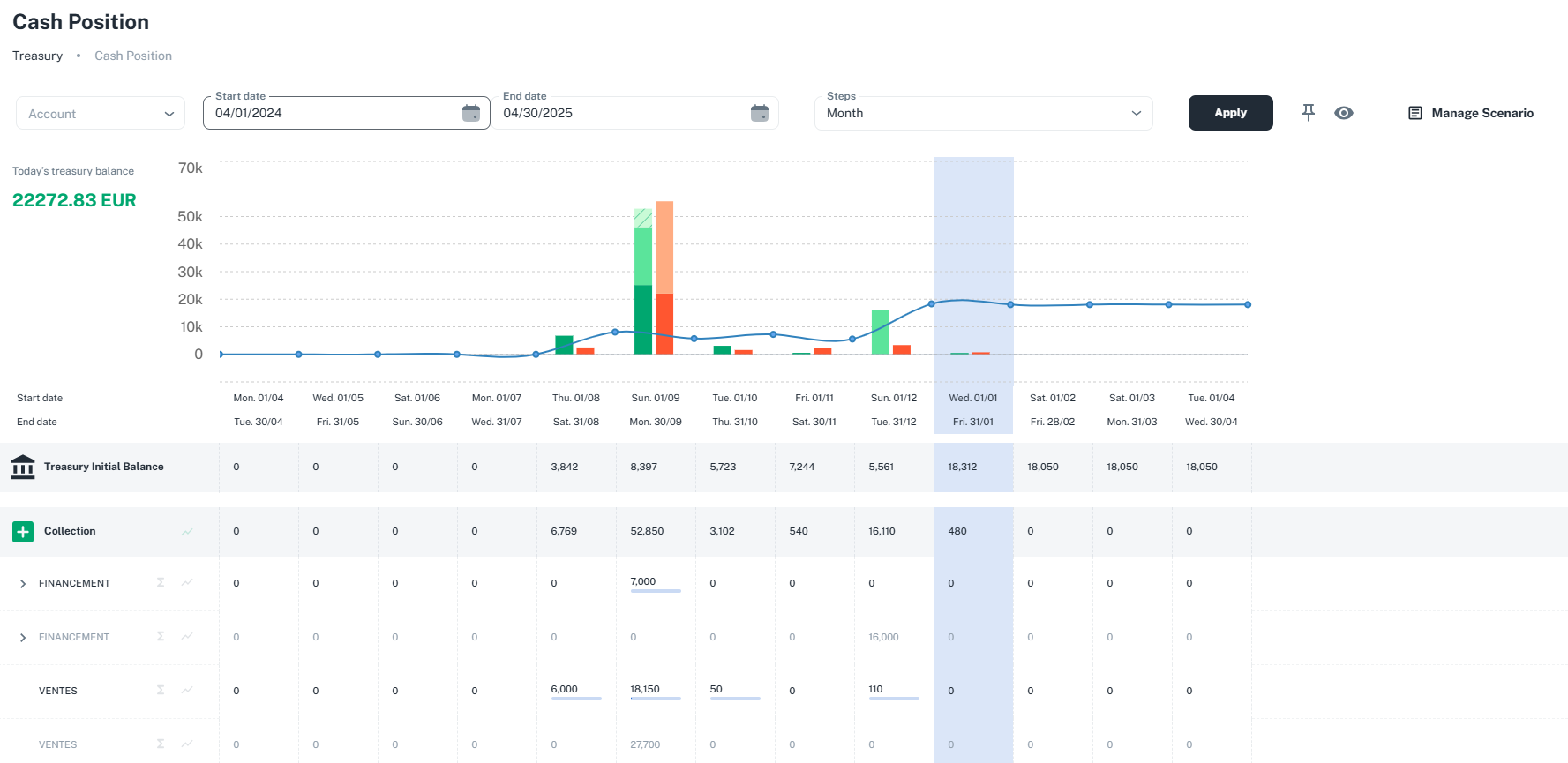

To illustrate, in Cashpower, the cash flow plan is organized in rows that group monthly totals for collections and disbursements, as well as the forecasted cash balance at the end of the period.

On the visual dashboard, a blue curve shows the available cash balance in real-time. Collections are displayed in green, and disbursements are in red, presented as charts for a clear view of financial flows. The color code also distinguishes the status of revenues and expenses. Dark shades represent amounts already deposited in the bank, lighter shades represent invoiced but not yet collected amounts, and shaded areas show amounts still allocated in the budget.

It’s important to note that the cash flow forecast is a key element among the four main financial forecasting tables. The first is the forecasted income statement (P&L), which presents the expected costs and revenues of the company. The second is the forecasted balance sheet, which provides a snapshot of the company’s financial position at the end of each period, listing its assets and liabilities, usually over a 3-year period. The third is the forecasted financing plan, which details the sources of investment financing and how it will be used. The fourth is the forecasted cash flow plan, which tracks the evolution of cash flow by showing the expected inflows and outflows, ensuring liquidity management.

You can try Cashpower for free by filling out the form here: https://cashpower.ai/getting-started/. However, if you prefer not to use Cashpower to automate your cash flow tracking, we offer an Excel template. The disadvantage of Excel is that the data entry and tracking must be done manually, unlike Cashpower, where the platform automatically pulls your bank transactions and generates a cash flow plan. You can then add your budget forecasts for each month, week, or day.

Here’s the link to download the Excel template from Google Drive: [here].

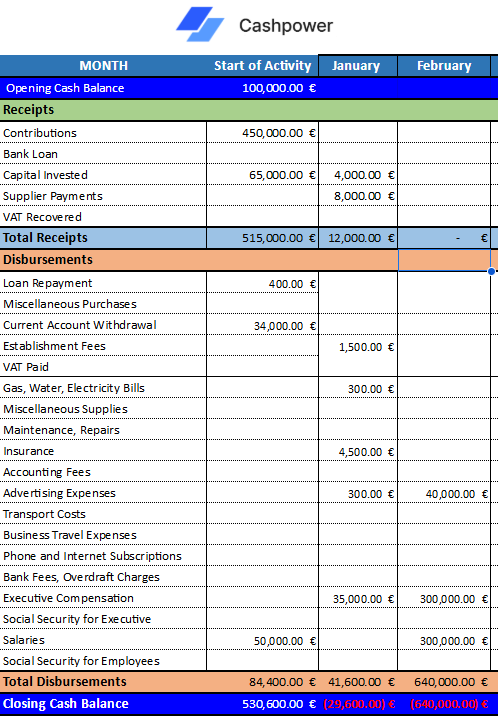

The Excel template we offer looks as follows (the numbers are for illustrative purposes). The first important step is to account for purchases and sales with VAT included, not excluding VAT. The company pays with VAT and then remits the collected VAT excess to the tax authorities or recovers the deductible VAT. Be careful: depending on your business, many other items may be added to your income and expenses. The table should always be adjusted accordingly.